Tag: Truckload

Is Your Supply Chain Ready For Weather Disruptions?

Is Your Supply Chain Ready For Weather Disruptions?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - May 11, 2021 To a large extent, Supply Chain and uncertainty go hand in hand. Driver delays, transportation failure, strikes, hike in fuel prices, carrier capacity shortage, vendor hold-ups, thefts, and fires at warehouses [...]

Roadcheck Week is Coming: May 4-6

Roadcheck Week is Coming: May 4-6Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - March 16, 2021 Roadcheck week is a program created by the Commercial Vehicle Safety Alliance (CVSA) which will deploy inspectors across the country to ensure that commercial vehicles and their drivers are upholding the set safety standards. [...]

Better Truckload Operations Efficiency Through Digitalization

Better Truckload Operations Efficiency Through DigitalizationShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 19, 2021 Digital trucking is bringing unprecedented, large-scale benefits to the national transportation grid. Digitization takes living, real-time data from once futuristic fantasy to practical present-day tools. Companies who embrace these changes can stay ahead [...]

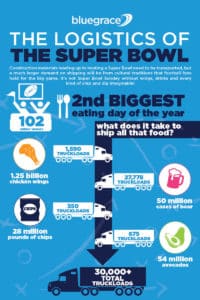

The Logistics Of The Super Bowl

The Logistics Of The Super BowlShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 2, 2021 Not even COVID can stop what is according to Supply Chain 247 “the world’s most-watched single sporting event”. As Tampa, Florida prepares to host Super Bowl LV, a litany of logistics experts huddle to [...]

How Can A 3PL Help My Organization Grow?

How Can A 3PL Help My Organization Grow?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 10, 2020 Now, more than ever before, businesses are being tested. Between the political climate of a tense presidential election year, the global pandemic, and natural disasters, many organizations have been finding it [...]

What the Freight Industry Might Learn from COVID-19

What the Freight Industry Might Learn from COVID-19Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 6, 2020 When the pandemic began to spread, the world was simply not prepared. Businesses and governments had to scramble to move an unprecedented volume of critical supplies around the world faster than [...]

Digitalization Is Ushering Visibility Into Supply Chains

Digitalization Is Ushering Visibility Into Supply ChainsShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 3, 2020 The North American trucking industry is extremely fragmented, as over 90 percent of all fleets own six trucks or fewer. This fragmentation, aside from inhibiting technology incursion, has impeded visibility and transparency [...]

Finalizing Your 2021 Transportation Budget – The New Normal

Finalizing Your 2021 Transportation Budget – The New NormalShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - October 14, 2020 Freight Budgeting for 2021 is going to be very different from the traditional budgeting done in previous years. The effects of the economic shutdowns stemming from the COVID-19 crisis have [...]

Digitalization In Trucking

Digitalization In TruckingShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - September 30, 2020 Digitalization, as an industry trend in the logistics world, has emerged quite late. However, now that digitalization and innovation seem to have caught up the industry's pace, much transformation can be expected. Digitalization refers to using [...]

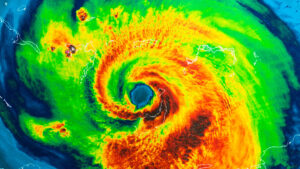

Experts Warn 2020 will be The Worst Hurricane Season In Years: Is Your Company Ready to Weather the Storm?

WebinarsShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - August 24, 2020 Every company has contingency plans for when things don’t go as expected. Whether it’s a backup supplier in the case of a material shortage; or a different carrier for when capacity gets tight. However, when the weather picks [...]

Understanding The Need For A Stronger Supply Chain

Understanding The Need For A Stronger Supply ChainShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - August 11, 2020 As much as we’d like to believe that our supply chains are both quick enough to react to major disruption and flexible enough to maneuver around major obstacles, the global pandemic [...]

Detention and Dwell Times: The Menaces of Supply Chain Efficiency

Detention and Dwell Times: The Menaces of Supply Chain EfficiencyShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - August 3, 2020 Prolonged dwell times have been an age-old inefficiency that the trucking industry has been trying to curb. Longer dwell times affect the drivers, carriers and shippers alike. An estimated [...]

Outside-In: The Future of Supply Chain Planning

Supply chains are evolving fast. To keep up with the fast pace of supply chain evolution it is important for supply chain planners to upgrade their skills and step up their business planning and forecasting techniques. If the planners lag behind, it will have an adverse impact on not only the supply chain but also [...]

Diversification Is The Lifeblood Of Your Supply Chain

In the current economic scenario where businesses are shutting shops with alarming regularity, it has become necessary for organizations to diversify their supply chain. Given the importance of the subject, we hosted a webinar on the topic – From Chips to Dips in Service? Supply Chain Impact of Diversifying Chris Kupillas, VP Sales, at BlueGrace Logistics […]

The Rise of the 3PL for Managed Transportation Services

The Rise of the 3PL for Managed Transportation ServicesShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - March 26, 2020 Managed transportation services have widely become an integral function of modern supply-chain. As reported by Steve Baker of Forbes, the outsourcing of managed transportation services to other entities has different terminology [...]