Tag: truckers

Is Your Supply Chain Ready For Weather Disruptions?

Is Your Supply Chain Ready For Weather Disruptions?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - May 11, 2021 To a large extent, Supply Chain and uncertainty go hand in hand. Driver delays, transportation failure, strikes, hike in fuel prices, carrier capacity shortage, vendor hold-ups, thefts, and fires at warehouses [...]

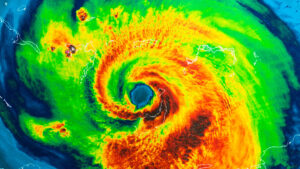

Experts Warn 2020 will be The Worst Hurricane Season In Years: Is Your Company Ready to Weather the Storm?

WebinarsShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - August 24, 2020 Every company has contingency plans for when things don’t go as expected. Whether it’s a backup supplier in the case of a material shortage; or a different carrier for when capacity gets tight. However, when the weather picks [...]

What will 2019 bring for the trucking industry?

What will 2019 bring for the trucking industry? Will there be a capacity crunch, demand – supply imbalance? Will the rates increase or will they remain steady? What would be more cost effective – booking spot rates or negotiating contract rates? How will the changes in the trucking industry impact a shipper’s business? Knowledge of […]

Can Your Supply Chain Weather The Storm?

With two months left to go of this hurricane season, the eastern seaboard has been hammered by Hurricane Florence. While the storm has died out, the overall damage reports are still rolling in. As of now, over 500,000 businesses and homes are without power, mostly in North Carolina. Prolific flooding and rainfall continue to be […]

Customs Changes from Trade Tariffs

Customs Changes from Trade TariffsShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - September 6, 2018 Trump’s trade talks have created a nervous atmosphere for manufacturers, suppliers, and freight companies. Unsure as to whether there will be an all-out trade war between the United States and China (not to mention [...]

Rising Concern Over Trucking Shortage and Tariffs

The potential trade war has been sparking considerable concern within the freight and logistics sector. With sanctioned countries threatening and even enacting their own forms of punitive retribution, many are wondering what the overall effects of the tariffs and trade restrictions will be on the industry as a whole. The growing shortage in the trucking […]

Is Your Supply Chain Ready for NAFTA Changes?

The North American Free Trade Agreement (NAFTA) is about to be on the block for renegotiation. Possible changes from the renegotiation can take on many forms including, but not limited to: Adjustments to the Rules of Origin for Product Content More-stringent Labor Standards, Possible withdrawal return to World Trade Organization most-favored-nation tariffs. These potential changes [...]

Accelerating Business Growth And Lowering Cost With Data Analytics

Too many companies are experiencing transportation and freight expenses as one of their top three costs. Smaller companies feel the pinch the most. They typically incur greater logistics costs than medium and large sized companies, as do companies that sell lower product value goods. In a recent survey, 32% of online retailers expected logistics and delivery to be [...]

The End of NAFTA Could Be a Nightmare for Truckers

Recent actions from the U.S. President, Donald Trump, have truckers more than a little concerned. During his time on the campaign trail Trump has made his opinion on foreign industries, Mexico in particular, very clear. Touting his “America First” slogan, Trump promised the American people that he would focus on bringing jobs back to the […]