Tag: ltl

Understanding Truckload Rates: Contract Versus Spot Market

Understanding Truckload Rates: Contract vs SpotShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - June 2, 2022 Freight markets always are on the move. Freight capacity and, therefore, truckload rates are constantly shifting. Some market shifts are more extreme than others. This level of volatility can potentially leave shippers in [...]

LTL Is Capturing The Middle-Mile

LTL Is Capturing The Middle-MileShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - April 8, 2021 COVID-19 has made a tremendous impact around the globe, and the United States was certainly no exception. The less-than-truckload (LTL) sector in particular saw volumes drop to levels not experienced since the Great Depression. [...]

Roadcheck Week is Coming: May 4-6

Roadcheck Week is Coming: May 4-6Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - March 16, 2021 Roadcheck week is a program created by the Commercial Vehicle Safety Alliance (CVSA) which will deploy inspectors across the country to ensure that commercial vehicles and their drivers are upholding the set safety standards. [...]

Shipping Challenges For The 2021 Produce Season

Shipping Challenges For The 2021 Produce SeasonShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 9, 2021 Volume increases in shipping can drive up rates and create challenging conditions in freight capacity. Under normal conditions, the strain on CPG shippers occurs tidally. Produce season causes disruptions, but occurs with [...]

Outlook for LTL in 2021: A Pressurized Sector

Outlook for LTL in 2021: A Pressurized SectorShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 5, 2021 The height of the COVID-19 pandemic forced many businesses to close their doors, in some cases for good. In March and April, during the early days of the “shelter in place” [...]

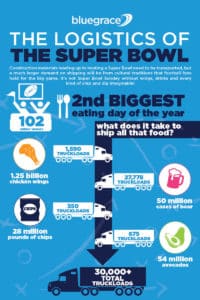

The Logistics Of The Super Bowl

The Logistics Of The Super BowlShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 2, 2021 Not even COVID can stop what is according to Supply Chain 247 “the world’s most-watched single sporting event”. As Tampa, Florida prepares to host Super Bowl LV, a litany of logistics experts huddle to [...]

Top 3 Factors To Consider In 2021 For The Trucking Industry

Top 3 Factors To Consider In 2021 For The Trucking IndustryShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - January 26, 2021 With the effects of 2020 reverberating into the new year, business carries on in some unusual new ways. Most notably, COVID-19 disrupted the global supply chain and profoundly altered [...]

Shifts in Consumer Trends and the Future of Retailers

Shifts in Consumer Trends and the Future of RetailersShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - January 19, 2021 Consumer behavior during the global pandemic of 2020 is proving difficult to absorb for many businesses. Fraught with the risk of infection, restricted business hours, and massive unemployment, the average [...]

Help Wanted: The 2020 Seasonal Logistics Hiring Boom

Help Wanted: The 2020 Seasonal Logistics Hiring BoomShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - December 2, 2020 The seasonal shopping madness is already underway as retailers begin priming their customers for the holidays. 2020 has, without a doubt, been one of the strangest years for just about everything. [...]

How Technology Can Enhance Your Supply Chain In Four Ways

How Technology Can Enhance Your Supply Chain In 4 WaysShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 24, 2020 Supply chain disruptions are just a part of doing business. Seasonal events such as holiday shopping, black swan weather events, geopolitical tensions, and, in the case of 2020, a [...]

Preparing for 2020’s “Shipageddon”

Preparing for 2020’s “Shipageddon”Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 19, 2020 2020 has been different from the norm in just about every single way imaginable, so it should come as no surprise that freight is going off the rails. This year we’re seeing big box retailers [...]

Will Q4 of 2020 Change the Way We Look at Bid Season?

Will Q4 of 2020 Change the Way We Look at Bid Season?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 17, 2020 If it were a normal year, the fourth quarter would bring a steady increase in trucking rates. However, 2020 has been anything but normal, so what does [...]

How Can A 3PL Help My Organization Grow?

How Can A 3PL Help My Organization Grow?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 10, 2020 Now, more than ever before, businesses are being tested. Between the political climate of a tense presidential election year, the global pandemic, and natural disasters, many organizations have been finding it [...]

What the Freight Industry Might Learn from COVID-19

What the Freight Industry Might Learn from COVID-19Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 6, 2020 When the pandemic began to spread, the world was simply not prepared. Businesses and governments had to scramble to move an unprecedented volume of critical supplies around the world faster than [...]

Digitalization Is Ushering Visibility Into Supply Chains

Digitalization Is Ushering Visibility Into Supply ChainsShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 3, 2020 The North American trucking industry is extremely fragmented, as over 90 percent of all fleets own six trucks or fewer. This fragmentation, aside from inhibiting technology incursion, has impeded visibility and transparency [...]