Tag: ltl shipping

Outlook for LTL in 2021: A Pressurized Sector

Outlook for LTL in 2021: A Pressurized SectorShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 5, 2021 The height of the COVID-19 pandemic forced many businesses to close their doors, in some cases for good. In March and April, during the early days of the “shelter in place” [...]

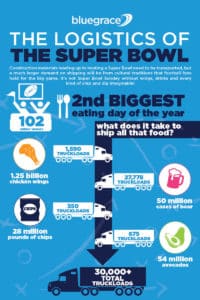

The Logistics Of The Super Bowl

The Logistics Of The Super BowlShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 2, 2021 Not even COVID can stop what is according to Supply Chain 247 “the world’s most-watched single sporting event”. As Tampa, Florida prepares to host Super Bowl LV, a litany of logistics experts huddle to [...]

Understanding The Need For A Stronger Supply Chain

Understanding The Need For A Stronger Supply ChainShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - August 11, 2020 As much as we’d like to believe that our supply chains are both quick enough to react to major disruption and flexible enough to maneuver around major obstacles, the global pandemic [...]

Detention and Dwell Times: The Menaces of Supply Chain Efficiency

Detention and Dwell Times: The Menaces of Supply Chain EfficiencyShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - August 3, 2020 Prolonged dwell times have been an age-old inefficiency that the trucking industry has been trying to curb. Longer dwell times affect the drivers, carriers and shippers alike. An estimated [...]

Controlling Costs and Preventing Accessorial Loss

Want A Free Supply Chain Analysis? Controlling costs is critical for any business to be successful. When working with a supply chain, the more complex it is, the more chances there are for additional costs and surcharges, any of which can cost your company a great deal of extra money. They are any […]

Driving Down Supply Chain Costs with Mode Optimization

Want A Free Supply Chain Analysis? The term “optimization” is thrown around often in the logistics landscape. It’s true, optimization is an indispensable part of a well-run business model. Of course, every business owner wants their operations running as tightly and efficiently as possible, but the footwork required to determine how to optimize your […]

Walmart’s OTIF Policy Gets Harder

Walmart’s OTIF Policy Gets Harder Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - May 2, 2018 Want A Free Supply Chain Analysis? On Time In Full is a policy that Walmart created back in 2016 and implemented in August of 2017. In an attempt to drive their proficiency up [...]