News

Find everything you need to know with our extensive library of case studies, white papers, guides, reports, latest news, and industry trends.

LLMs, Optimization and Automation: Supply Chain's Defenses Against Market Swings

LLMs, Optimization and Automation: Supply Chain's Defenses Against Market Swings

Read News

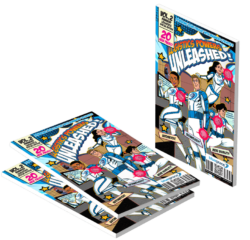

Modex meets Comicon: BlueGrace Logistics releases "Logistics Powers Unleashed!" comic book

Modex meets Comicon: BlueGrace Logistics releases "Logistics Powers Unleashed!" comic book

Read News

BlueGrace Logistics heralds acquisition of Evos Smart Tools

BlueGrace Logistics heralds acquisition of Evos Smart Tools

Read News

BlueGrace Logistics Confidence Index® Signals Flat Shipper Confidence for Q2 2024

BlueGrace Logistics Confidence Index® Signals Flat Shipper Confidence for Q2 2024

Read News

Technology Brings A New Dawn for Drayage

Technology Brings A New Dawn for Drayage

Read News

Logistics Confidence Index Signals Flat Shipper Confidence for Q2

Logistics Confidence Index Signals Flat Shipper Confidence for Q2

Read News

Signs of Confidence Amidst

Signs of Confidence Amidst

Read News

2024 Supply chain outlook: When will markets flip back in carriers' favor?

2024 Supply chain outlook: When will markets flip back in carriers' favor?

Read News

Signs of Q1 optimism are seen in BlueGrace Logistics Confidence Index

Signs of Q1 optimism are seen in BlueGrace Logistics Confidence Index

Read News

US-Mexico Trade Trends Indicate Nearshoring Has Momentum

US-Mexico Trade Trends Indicate Nearshoring Has Momentum

Read News

Embracing the Chill: How the Consumer Shift from Fresh to Frozen Effects Cold Chain Transportation

Embracing the Chill: How the Consumer Shift from Fresh to Frozen Effects Cold Chain Transportation

Read News

How to Navigate Your Supply Chain During Market Swings

How to Navigate Your Supply Chain During Market Swings

Read News

Your Top 11 Questions about Expedited Freight Services Answered ASAP

Your Top 11 Questions about Expedited Freight Services Answered ASAP

Read News

What Inventory, Order Volumes Could Mean for Holiday Freight

What Inventory, Order Volumes Could Mean for Holiday Freight

Read News

Tech That Helps Small to Mid-Size Carriers Fight Against a Volatile Economy

Tech That Helps Small to Mid-Size Carriers Fight Against a Volatile Economy

Read News

Unlock this whitepaper for expert logistics insights

Get expert logistics insights delivered straight to your inbox

Get expert logistics insights delivered straight to your inbox

Get expert logistics insights delivered straight to your inbox

"*" indicates required fields

Zaregistrujte se nyní a začněte svou vzrušující cestu do světa online sázení Ice Casino!

BetAndreas - будет твоим прексрасным будущим!

Лучшее что ты мог найти на просторах интернета собрано здесь - BetAndreas !