Tag: technology

Is Your Supply Chain Ready For Weather Disruptions?

Is Your Supply Chain Ready For Weather Disruptions?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - May 11, 2021 To a large extent, Supply Chain and uncertainty go hand in hand. Driver delays, transportation failure, strikes, hike in fuel prices, carrier capacity shortage, vendor hold-ups, thefts, and fires at warehouses [...]

The Supply Chain of the Christmas Tree

The Supply Chain of the Christmas TreeShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - December 9, 2020 The Christmas tree has become one of the most iconic staples of the holiday season. While the origins of the evergreen tree stems back much further, Christmas tree sales in the United [...]

Automated Logistics is On the Horizon

Automated Logistics is On the HorizonShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - September 25, 2020 Boston Dynamics new CEO, Robert Playter, has his sights set on the logistics market as the company’s first vertical. BD has proven that it has the ability to produce robots at scale as [...]

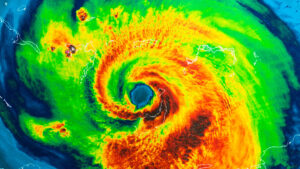

Experts Warn 2020 will be The Worst Hurricane Season In Years: Is Your Company Ready to Weather the Storm?

WebinarsShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - August 24, 2020 Every company has contingency plans for when things don’t go as expected. Whether it’s a backup supplier in the case of a material shortage; or a different carrier for when capacity gets tight. However, when the weather picks [...]

Automation In The Supply Chain

Automation In The Supply ChainShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - March 31, 2020 In a world that is constantly evolving and adapting to the newest technology, it’s important that companies keep up with the changes. We are at a point in time where consumers are getting their [...]

Supply Chain Technology 2020: What to Expect?

Supply Chain Technology 2020: What to Expect?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - January 29, 2020 Technology has become synonymous with supply chains. It’s not only creating new and innovative products to support global supply chains, but is also rapidly changing how the industry operates. These new technologies [...]

Controlling Costs and Preventing Accessorial Loss

Want A Free Supply Chain Analysis? Controlling costs is critical for any business to be successful. When working with a supply chain, the more complex it is, the more chances there are for additional costs and surcharges, any of which can cost your company a great deal of extra money. They are any […]

7 Benefits of Outsourcing Logistics to a 3PL

7 Benefits of Outsourcing Logistics to a 3PLShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - March 13, 2019 To outsource logistics or manage it internally is a major point of consideration for organizations. The decision is usually arrived at after extensive cost-benefit analysis of both the alternatives. While the [...]

Will 2019 Be a Carrier or a Shipper-led Market?

Trucking is a cyclical business. There are periods of intense growth followed by a lull and then there are periodic seasonalities which may vary from one industry to another. How long each period lasts depends on the internal and external factors that greatly impact the trucking industry. International trade policies and volume, capacity, manufacturing industry’s […]

How to Build an Effective Logistics Communication Process

How to Build an Effective Logistics Communication Process Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 28, 2019 Communication is a vital aspect of building a successful business. An effective communication process ensures that information flows seamlessly between departments and amongst the various teams on time and in a [...]

What will 2019 bring for the trucking industry?

What will 2019 bring for the trucking industry? Will there be a capacity crunch, demand – supply imbalance? Will the rates increase or will they remain steady? What would be more cost effective – booking spot rates or negotiating contract rates? How will the changes in the trucking industry impact a shipper’s business? Knowledge of […]

Urban Logistics is Growing

We are witnessing one of the most interesting times in the development of logistics. Shippers and Carriers alike are working towards creating, innovating, and performing all out (and much needed) overhaul of the way we look at delivering packages. Online and legacy retailers both are encouraged to work with their logistics partners to not only […]

Your Role in the Digitally Dominated Future

In 2018, the world is more connected than it has ever been before. With the advent and popularization of smartphones, we are able to instantaneously make connections all over the world in ways unimaginable just 20 years ago, before we knew the names Facebook, Twitter, and Amazon. Today, these platforms not only heighten our social […]

Make Logistics Your Strategic Advantage

The November 1977 issue of Harvard Business Review carried an article titled “Logistics – Essential to Strategy”. Citing reasons such as “a decline in the growth rate of domestic markets, large incremental costs of energy, and an increasing emphasis on multinational markets in corporate strategies”, it foretold that logistics will become an essential part of the “corporate strategy of the future”. There […]

Connected Logistics is the Future of Global Trade

According to reports, the connected logistics market is set to grow at a CAGR of 30-35 percent by the year 2021. In the next 2 to 3 years, analysts predict the connected logistics industry to be worth USD 40 – 50 Billion. It is expected to change the entire landscape of the global supply chain. […]