Tag: supply chain

Unwrapping the Supply Chain of Halloween 2022

Unwrapping the Supply Chain of Halloween 2022Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - October 20, 2022 Where are consumers spending the most this spooky season and will the Halloween supply chain be able to keep up this year? What's in the article: What consumers spending the most on [...]

Why a Strong Customer Support Team is Important When Choosing a 3PL

Why a Strong Customer Support Team is Important When Choosing a 3PLShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search Kyle Pendergrass - October 6, 2022 A strong 3PL customer support team is essential when selecting a logistics partner. Learn the characteristics of the best freight shipping support teams. What's in the article: [...]

Top Reasons to Appreciate Truck Drivers

Top Reasons to Appreciate Truck DriversShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - September 15, 2022 In honor of National Truck Driver Appreciation Week, we’re taking a moment to show our gratitude and pay respect to all the professional truck drivers for all that they do. Life just wouldn’t [...]

The Current State of Imports and Exports

The Current State of Imports and ExportsShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - September 12, 2022 Imports and exports are being disrupted by turbulence in the supply chain. What are the causes, impacts, and how can shippers successfully navigate this environment? What's in the article: The Supply Chain [...]

What To Expect for the 2022 Holiday Shipping Season

What To Expect for the 2022 Holiday Shipping SeasonShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - August 18, 2022 Educating yourself to prepare for holiday season is crucial to your supply chain. Learn what to expect for the 2022 holiday shipping season. What's in the article: Port congestion Container [...]

Project Management Framework for Today’s 3PL

Project Management Framework for Today’s 3PLShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - July 20, 2022 Project management framework is a set of methods, processes, and rules applied to the entire project lifecycle. Following the steps in the framework act as a guide for defining the goals, scope, and [...]

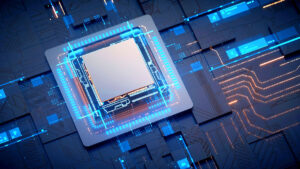

The Chip Shortage Explained

The Chip Shortage ExplainedShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - June 30, 2022 Chip shortages continue to escalate as manufacturers are unable to meet demand. The backlog of supply chain issues began pre-pandemic due to an increased demand for technology, only to exponentially worsen during the pandemic. What's [...]

Understanding Truckload Rates: Contract Versus Spot Market

Understanding Truckload Rates: Contract vs SpotShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - June 2, 2022 Freight markets always are on the move. Freight capacity and, therefore, truckload rates are constantly shifting. Some market shifts are more extreme than others. This level of volatility can potentially leave shippers in [...]

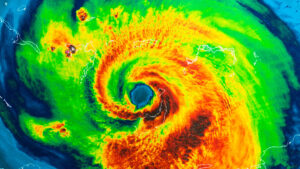

Is Your Supply Chain Ready For Weather Disruptions?

Is Your Supply Chain Ready For Weather Disruptions?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - May 11, 2021 To a large extent, Supply Chain and uncertainty go hand in hand. Driver delays, transportation failure, strikes, hike in fuel prices, carrier capacity shortage, vendor hold-ups, thefts, and fires at warehouses [...]

LTL Is Capturing The Middle-Mile

LTL Is Capturing The Middle-MileShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - April 8, 2021 COVID-19 has made a tremendous impact around the globe, and the United States was certainly no exception. The less-than-truckload (LTL) sector in particular saw volumes drop to levels not experienced since the Great Depression. [...]

Business Intelligence: Bringing Your Operations To The Next Level

Business Intelligence: Bringing Your Operations To The Next LevelShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - April 6, 2021 Logistics and the global supply chain drive the world as we know it today. Everyday tasks such as going to the grocery store to pick up ingredients for dinner to [...]

Delivering A Passion For Logistics

Delivering A Passion For LogisticsShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 23, 2021 I have a passion for logistics and recently joined the BlueGrace Logistics team as Chief Marketing Officer. In my initial weeks of onboarding, I’ve been able to connect with many of the customer facing [...]

Better Truckload Operations Efficiency Through Digitalization

Better Truckload Operations Efficiency Through DigitalizationShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 19, 2021 Digital trucking is bringing unprecedented, large-scale benefits to the national transportation grid. Digitization takes living, real-time data from once futuristic fantasy to practical present-day tools. Companies who embrace these changes can stay ahead [...]

Top 3 Factors To Consider In 2021 For The Trucking Industry

Top 3 Factors To Consider In 2021 For The Trucking IndustryShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - January 26, 2021 With the effects of 2020 reverberating into the new year, business carries on in some unusual new ways. Most notably, COVID-19 disrupted the global supply chain and profoundly altered [...]

Lack of Safe Truck Parking Remains an Issue for 2021

Lack of Safe Truck Parking Remains an Issue for 2021Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - January 22, 2021 2021 is still carrying over problems from 2020. Hours of Service regulations have been amended as of June 1st, 2020, to provide greater flexibility without compromising the original intent, [...]