Tag: Freight

Understanding Truckload Rates: Contract Versus Spot Market

Understanding Truckload Rates: Contract vs SpotShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - June 2, 2022 Freight markets always are on the move. Freight capacity and, therefore, truckload rates are constantly shifting. Some market shifts are more extreme than others. This level of volatility can potentially leave shippers in [...]

Love In The Cold Chain

Love In The Cold ChainShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 3, 2022 Valentine’s Day presents some unique logistical challenges. Here’s how the supply chain rises to the occasion to get roses and chocolate covered strawberries to their destination on time through the cold chain. What’s in [...]

How Do I Keep My Freight From Freezing?

How Do I Keep My Freight From Freezing?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - January 20, 2022 Winter is rough on freight for many reasons. Snowstorms and ice can create dangerous travel conditions that delay trucks in the best case scenarios and can bring the supply chain to [...]

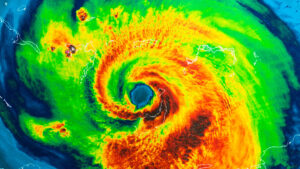

Is Your Supply Chain Ready For Weather Disruptions?

Is Your Supply Chain Ready For Weather Disruptions?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - May 11, 2021 To a large extent, Supply Chain and uncertainty go hand in hand. Driver delays, transportation failure, strikes, hike in fuel prices, carrier capacity shortage, vendor hold-ups, thefts, and fires at warehouses [...]

Roadcheck Week is Coming: May 4-6

Roadcheck Week is Coming: May 4-6Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - March 16, 2021 Roadcheck week is a program created by the Commercial Vehicle Safety Alliance (CVSA) which will deploy inspectors across the country to ensure that commercial vehicles and their drivers are upholding the set safety standards. [...]

Outlook for LTL in 2021: A Pressurized Sector

Outlook for LTL in 2021: A Pressurized SectorShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 5, 2021 The height of the COVID-19 pandemic forced many businesses to close their doors, in some cases for good. In March and April, during the early days of the “shelter in place” [...]

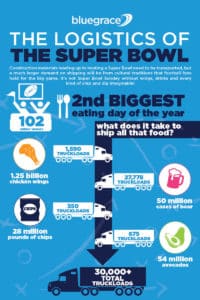

The Logistics Of The Super Bowl

The Logistics Of The Super BowlShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - February 2, 2021 Not even COVID can stop what is according to Supply Chain 247 “the world’s most-watched single sporting event”. As Tampa, Florida prepares to host Super Bowl LV, a litany of logistics experts huddle to [...]

Top 3 Factors To Consider In 2021 For The Trucking Industry

Top 3 Factors To Consider In 2021 For The Trucking IndustryShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - January 26, 2021 With the effects of 2020 reverberating into the new year, business carries on in some unusual new ways. Most notably, COVID-19 disrupted the global supply chain and profoundly altered [...]

The Supply Chain of the Christmas Tree

The Supply Chain of the Christmas TreeShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - December 9, 2020 The Christmas tree has become one of the most iconic staples of the holiday season. While the origins of the evergreen tree stems back much further, Christmas tree sales in the United [...]

Help Wanted: The 2020 Seasonal Logistics Hiring Boom

Help Wanted: The 2020 Seasonal Logistics Hiring BoomShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - December 2, 2020 The seasonal shopping madness is already underway as retailers begin priming their customers for the holidays. 2020 has, without a doubt, been one of the strangest years for just about everything. [...]

How Technology Can Enhance Your Supply Chain In Four Ways

How Technology Can Enhance Your Supply Chain In 4 WaysShow SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 24, 2020 Supply chain disruptions are just a part of doing business. Seasonal events such as holiday shopping, black swan weather events, geopolitical tensions, and, in the case of 2020, a [...]

Preparing for 2020’s “Shipageddon”

Preparing for 2020’s “Shipageddon”Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 19, 2020 2020 has been different from the norm in just about every single way imaginable, so it should come as no surprise that freight is going off the rails. This year we’re seeing big box retailers [...]

Will Q4 of 2020 Change the Way We Look at Bid Season?

Will Q4 of 2020 Change the Way We Look at Bid Season?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 17, 2020 If it were a normal year, the fourth quarter would bring a steady increase in trucking rates. However, 2020 has been anything but normal, so what does [...]

How Can A 3PL Help My Organization Grow?

How Can A 3PL Help My Organization Grow?Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 10, 2020 Now, more than ever before, businesses are being tested. Between the political climate of a tense presidential election year, the global pandemic, and natural disasters, many organizations have been finding it [...]

What the Freight Industry Might Learn from COVID-19

What the Freight Industry Might Learn from COVID-19Show SubmenuResources The Logistics Blog® Newsroom Whitepaper Case Study Webinars Indexes Search Search BlueGrace Logistics - November 6, 2020 When the pandemic began to spread, the world was simply not prepared. Businesses and governments had to scramble to move an unprecedented volume of critical supplies around the world faster than [...]